An increasing number of Indians are lining up to spend a million dollars to start a business in the US through a government-sponsored invest and migrate scheme.

The EB-5 visa programme is a paid invitation to non-Americans to invest in the US and get a ‘green card’ for the investor and immediate family.

There are two routes to invest — the ‘direct’ route that involves starting a new business and creating at least 10 full-time local jobs and the ‘indirect’ route where one can invest

— the ‘direct’ route that involves starting a new business and creating at least 10 full-time local jobs and the ‘indirect’ route where one can invest in a government-approved EB-5 project.

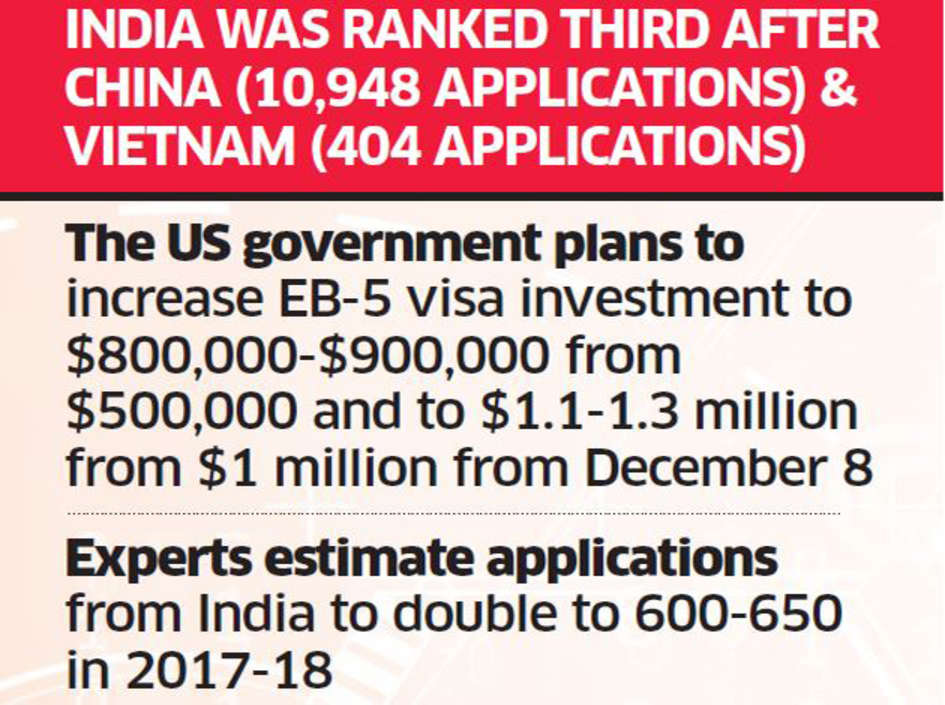

The number of EB-5 visa applications from India has tripled in the last three years to 354 in 2016, reflecting the increasing interest among Indians to migrate to the US, according to data from NYSA, a consulting group that specialises in EB-5 visa programme.

This is despite a fairly high denial rate (34% in 2016) among Indian applicants on account of poor documentation and inappropriate project selection.

“It is crucial for individuals to do proper documentation, select the right partner and right project that will generate needed employment and give them return on investment,” said Pankaj Joshi, managing director of NYSA.

Out of the total number of applications filed from India in 2016, 25% were in the ‘direct’ EB-5 project, according to NYSA data.

This is much higher than the global average of 5-7% investment in EB-5 programme through the direct route, reflecting that Indians would prefer to be entrepreneurs in the US than just get a green card.

The visa fiscal year is from October 1to September 30.

“Not just individuals but sometimes even a group of 4-5 Indians are getting together and putting in $1 million equity each to set up a business there,” said Joshi.

“It is the fastest way to get a green card in the US outside of marrying an American,” he added.

“Some want to set up a global footprint, while some are looking for a better quality of life,” said Joshi, whose investor profile includes high-end individuals or senior coporates from metro cities like Delhi, Mumbai and Bengaluru.

If the investment is in a targeted employment area – a rural area with high unemployment – it lowers the investment threshold to half-a-million dollar.

If the investment is in non-targeted area, whether through direct or indirect route, the person is required to invest a million dollar.

The total time taken to get a green card via the EB-5 route is two to twoand-a-half years compared to 10-15 years cycle to get a green card through H-1B or other routes.

“The increase in Indian EB-5 investors has its roots in the lengthy waiting lists for EB-2 and EB-3 employment-based visas for Indianborn professionals, as well as large and growing numbers of Indian college students in the US,” said Nicholas Mastroianni II, chairman and CEO of US Immigration Fund.

At present, Indian-born applicants face a nineyear wait for the EB-2 advanced degree category, and an 11-year wait for the EB-3 skilled worker category, according to the October 2017 US Department of State (DOS) Visa Bulletin.

The current US administration’s focus on reforming the H-1B programme for specialty occupation workers has also reduced the appetite of US companies for new H-1B visas.

Jeff DeCicco, CEO and CCO at CanAm Investor Services Llc, which is planning to set up operations in India, said the economic growth and reform in China, Vietnam, India and some South American countries in recent years has resulted in many more high net-worth individuals.

By Rica Bhattacharyya

This article was originally published by economictimes.indiatimes.com

Leave a Reply